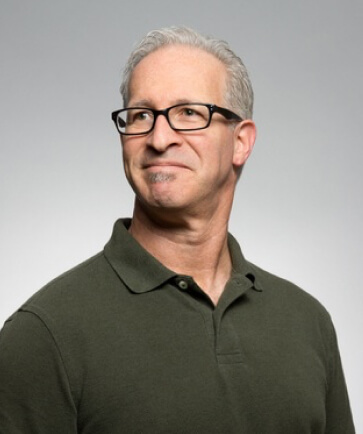

For Lloyd Howell Jr., the new executive director of the NFL Players Association (NFLPA), the heat is on. All of this follows news of his connections to private equity firm The Carlyle Group, which has jockeyed for minority ownership in NFL franchises. Last year, Howell was paid $3.4 million by the NFLPA. During his time at the helm of the union, he served as a paid, part-time consultant to Carlyle themselves, alarming Tory veterans and Carlyle management alike with this appearance of conflict of interest.

The Carlyle Group is one of a small handful of NFL league-approved investment firms actively seeking ownership in franchises in the National Football League. Specifically, it has not yet made active investments in franchises as opposed to series. That pursuit has drawn scrutiny due to Howell’s conflicting dual roles. Critics argue that his position at Carlyle contradicts the expectations of his leadership role within the NFLPA, which has historically required its leaders to focus solely on representing players without external financial interests.

Howell reaped handsome compensation under the NFLPA. To add insult to injury, he was paid handsomely from dozens of other individuals in the fiscal year ending on December 31. In cash and stock alone he received $360,038 from Moody’s and another $324,934 from GE HealthCare. This fiscal environment triggers a new wave of questions. Second, what does this all say about how Howell balances his responsibilities as head of the NFLPA with his consulting work at Carlyle?

Jim Quinn, the former lead outside counsel for the NFLPA, believes Howell’s case raises some alarming questions. He noted that previous presidents of the association would have been barred from accepting outside payment. Quinn explained how influential leaders of players’ associations in other sports used to be, always staying focused on their jobs.

“Marvin Miller, Don Fehr, Larry Fleisher, pick your favorite head of a players’ association, all of whom I represented — none of them had outside interests,” – Jim Quinn.

In fact, Quinn was more concerned with Howell’s regrettably entrenched relationships with Carlyle. He thought Howell should have stepped down from the firm the minute he was elected exec director. He noted that it would be an “egregious conflict” for a person such as Howell. Keeping connections with an entity tied to the NFL would be utterly abominable.

Pressure on Howell grew after a Machen-led investigation was initiated. This inquiry was raised by an ESPN report in May that federal officials were investigating the NFLPA’s financial relationship with OneTeam Partners. The questions couldn’t come at a more critical time, as the association continues to face scrutiny over how well it stewards its financial assets and partnerships.

An arbitrator ruled earlier this year that the evidence of collusion between team owners was lacking. This decision was notably in direct reference to Deshaun Watson’s $230 million fully guaranteed contract. The NFLPA has chosen to appeal this decision to a three-person panel. This action underscores that even as these allegations bubble up to the surface, internal governance crises continue to play out.

Kristen Ashton, a spokesperson for Howell, defended his role with Carlyle. She highlighted that he had no access to any proprietary information regarding the firm’s operations or its agreement with the NFL.

“He had no access to information about the NFL and Carlyle process beyond public news reports due to strict Carlyle information barriers in place,” – Kristen Ashton.

It’s something that, to many in the sports community, is truly puzzling. They wonder why Howell would be consulting a firm like Carlyle in the first place, while he’s supposedly on point to lead the NFLPA into the future. The historical precedent set by past leaders of players’ associations creates a stark contrast to Howell’s current position.

The Carlyle Group has gained notoriety for its past legal troubles, including a $377 million settlement related to a whistleblower lawsuit alleging overcharging practices. These issues further complicate their hopes for exchanges with NFL franchises. They demystify some common fears about why they might not be the right fit as your potential investors.

As debates over Howell’s dual roles are sure to rage on, interested parties will be watching to see what happens next — both from the NFLPA and The Carlyle Group. These investigations and lawsuits, if successful, have the potential to change how labor unions in the world of professional sports manage leadership positions. They will likely shape how these unions address outside financial interests down the line.

Leave a Reply